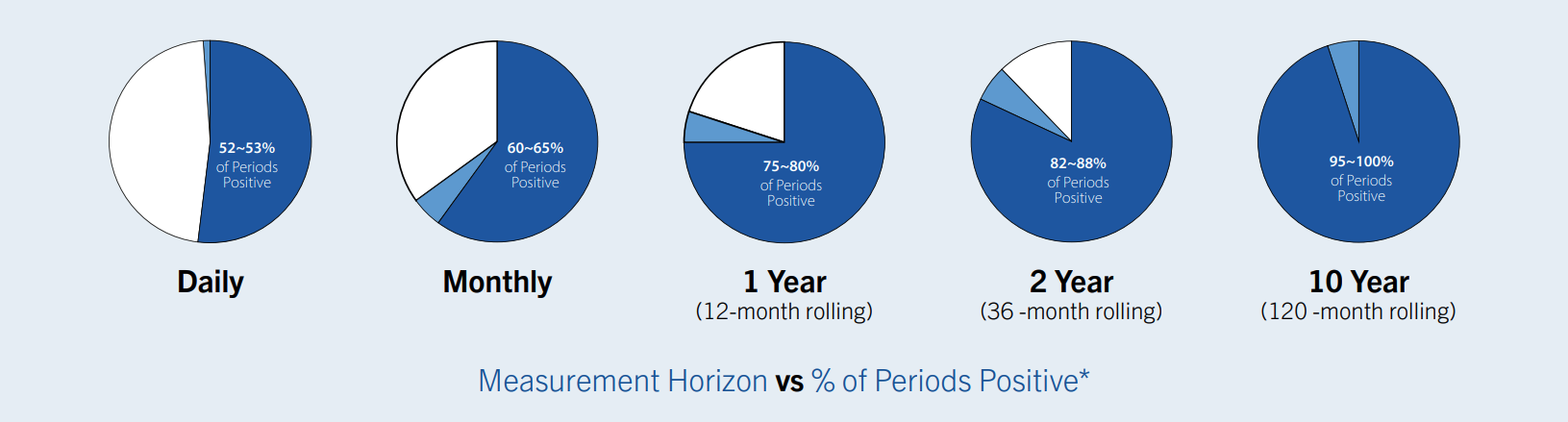

How Often Should You Review Your Portfolio – and Why It Matters

Historical Frequency of Positive S&P 500 Returns

(Illustrative data based on historical index perforamnce; past performance does not guarantee future results.)

Key Observations

- Time horizon influences outcomes. Historically, shorter measurement periods (such as daily or monthly) have shown roughly equal odds of gains or losses, while longer holding periods have exhibited a higher frequency of positive results.

- Review cadence and perspective. Reviewing portfolio values too frequently may emphasize short-term fluctuations, which could increase stress or prompt emotional decision-making. Reviewing results over longer time horizons may provide a clearer perspective on long-term progress toward goals.

- Behavioral considerations. Research in behavioral finance suggests that focusing on short-term market movements can increase anxiety and the likelihood of reactive decisions. A disciplined, long-term approach—aligned with your objectives and risk tolerance—can help maintain perspective during market volatility.

Download this document here.

Important limitations. Historical results are not predictive of future performance. The data above reflect U.S. equity markets only and do not account for fees, taxes, or individual portfolio differences. Investors may experience materially different results.

* Source: FRED (S&P 500 Price Index) and Robert Shiller Historical Data Series. Percentages are approximate and represent the proportion of periods with positive index returns over historical time frames. Indexes are unmanaged and cannot be invested in directly.

Shiller Data: https://shillerdata.com/

Federal Reserve Banks of St. Louis: https://fred.stlouisfed.org/data/SP500

This information is for educational purposes only and should not be considered investment advice. Data is based on historical sources believed to be reliable, but accuracy cannot be guaranteed. Investing involves risk, including the possible loss of principal.

Call us at KinneyMunro Wealth Advisors. We can help.